|

| Mortgage Rate Forecast July 2019 |

Mortgage rates have taken a turn for the better, and there’s an audible rushing sound as homeowners flock to refinance. Refinance applications jumped 47% week-over-week recently, according to the Mortgage Bankers Association.

It’s easy to see why.

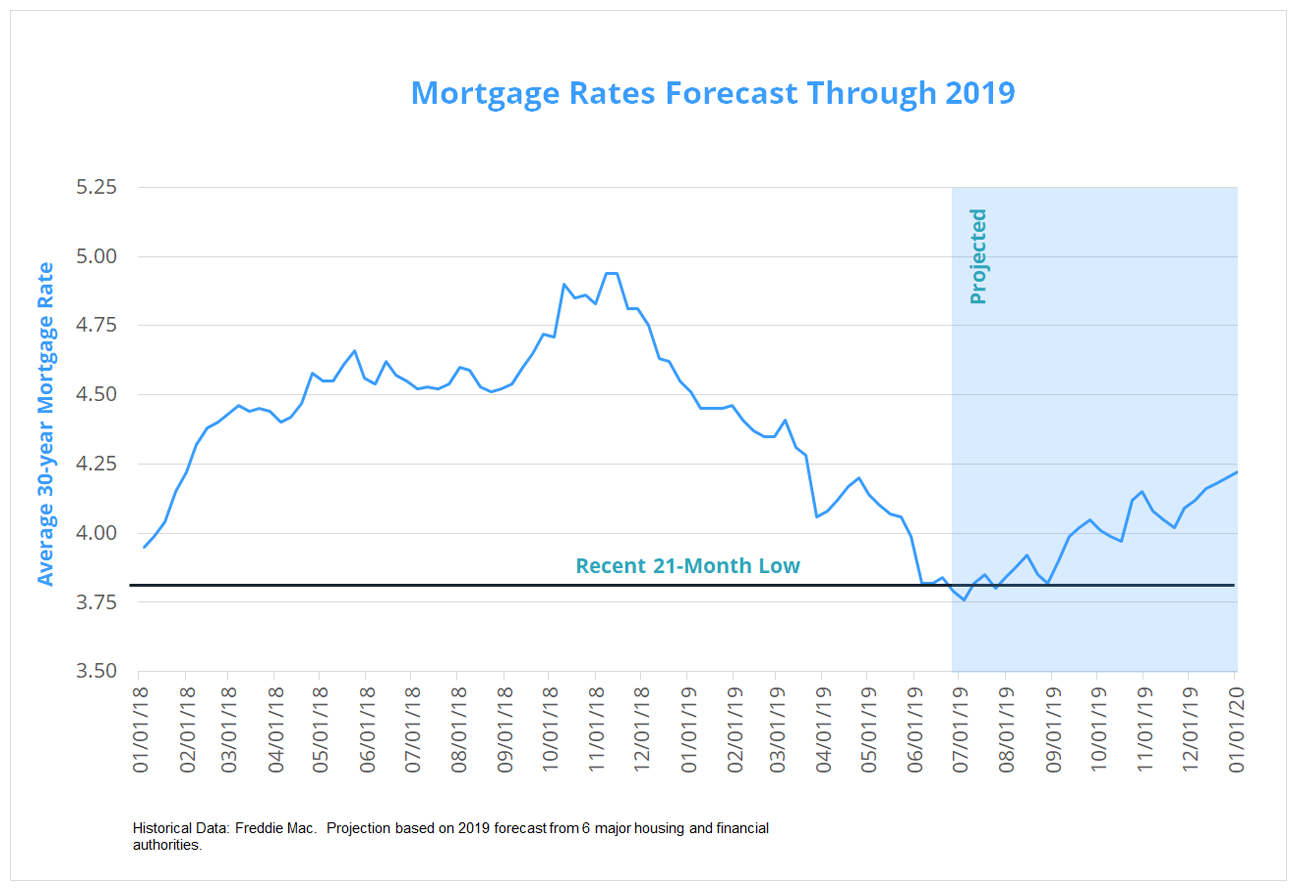

Mortgage agency Freddie Mac says average 30-year mortgage rates hit 3.82% in June, the lowest level in nearly two years. This is one of the best times in history to refinance, but will rates stay low?

Well, President Trump’s pressure on the Fed, plus low inflation, plus lackluster economic data has one commentator saying we’ll see the lowest rates ever in the next 12 months. How’s that for a forecast? Ready to capture a historic low rate? This could be your opportunity.

Predictions for July — July will be a wild ride for mortgage rates. Market-moving news will leave rates different than they were in June. The only question is, will they be more or less advantageous for mortgage shoppers Forecasts for 2019 put rates somewhere around 4.4% by the end of the year. That’s down from forecasts earlier in the year that called for rates in the 5s.

The funny thing is, though, that rates have been dropping since late 2018. Now, it appears rate increases could be much more subdued than first thought, if rates increase at all. Been looking for a good rate on a refinance or home purchase? Now might be the time to lock.

Mortgage agency Freddie Mac slashes its rate forecast for 2019-2020 Freddie Mac is one of the leading sources for rate forecasts in the U.S. So when it cuts its rate prediction by nearly 1%, consumers should pay attention. As recently as late-2018, the agency predicted 30-year mortgage rates at 5.1% for 2019. The group just cut that prediction to 4.3%.

As a home buyer, it could mean buying four bedrooms instead of three, or selecting the neighborhood you really wanted. What’s more, it foresees rates going up to just 4.5% in 2020. This is significant. A 0.80% lower rate on a $350,000 mortgage translates to a savings of $170 per month. As a home buyer, it could mean buying four bedrooms instead of three, or selecting the neighborhood you really wanted.

As a refinance candidate, it means finally having breathing room in your monthly budget. With current rates in the low 4s, and major agencies predicting they’ll stay that way, it makes sense to seriously consider a home purchase or refinance in the next few months.

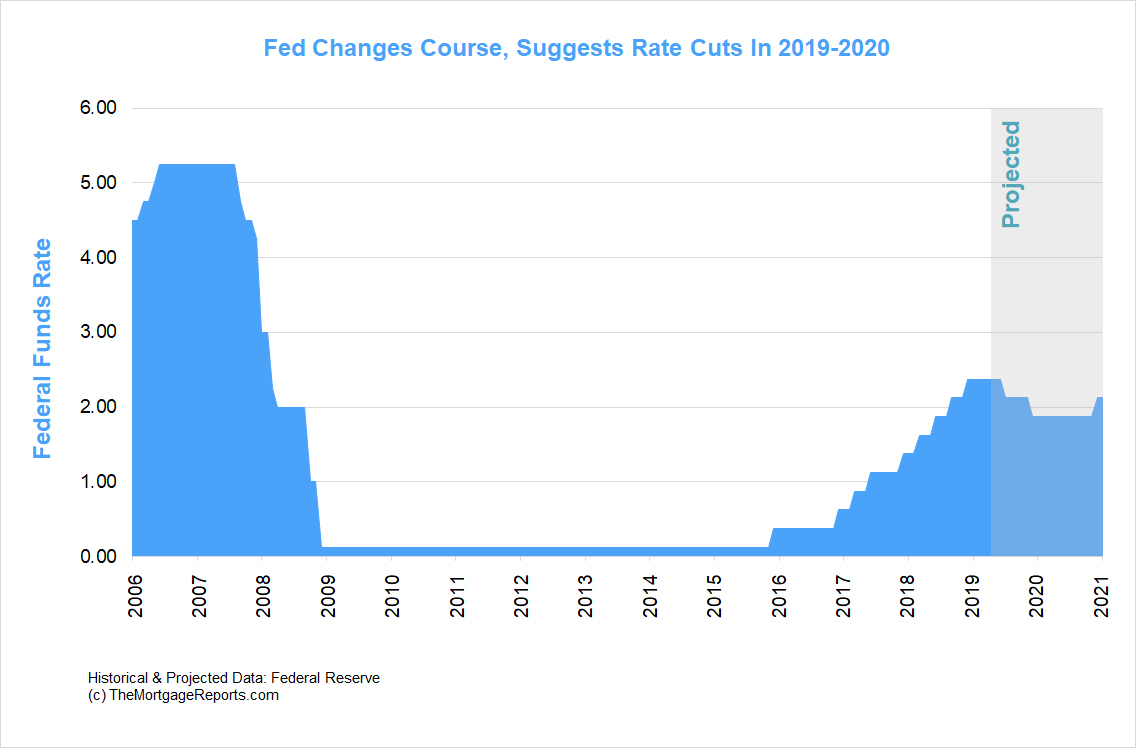

Expect a Fed rate cut in July — but low rates are available now. The Federal Open Market Committee (FOMC) adjourned on June 19 and didn’t issue a rate cut. But it did just about everything it could to hint at dropping rates in the near future. Mounting pressure from President Trump combined with lackluster economic data spurred the financial body to issue a post-meeting announcement that basically told markets that a cut was coming.

The statement said the economy is “rising at a moderate rate” instead of “solid” as it did in May. Additionally, it stated that “uncertainties” about economic expansion have increased. The change of tune has markets excited about falling rates. In fact, at the time of this writing, the CME FedWatch Tool shows a 100% chance of a rate cut at the next Fed meeting, adjourning July 31. But should mortgage consumers wait until then to lock in a rate? No. Markets are forward-looking, so mortgage rates have already fallen to fresh lows in anticipation of the new Fed paradigm.

themortgagereports.com/32667/mortgage-rates-forecast-fha-va-usda-conventional

No comments:

Post a Comment